Financial Stability Plan

Updated Nov. 17, 2025

Understanding UC Irvine’s Financial Landscape

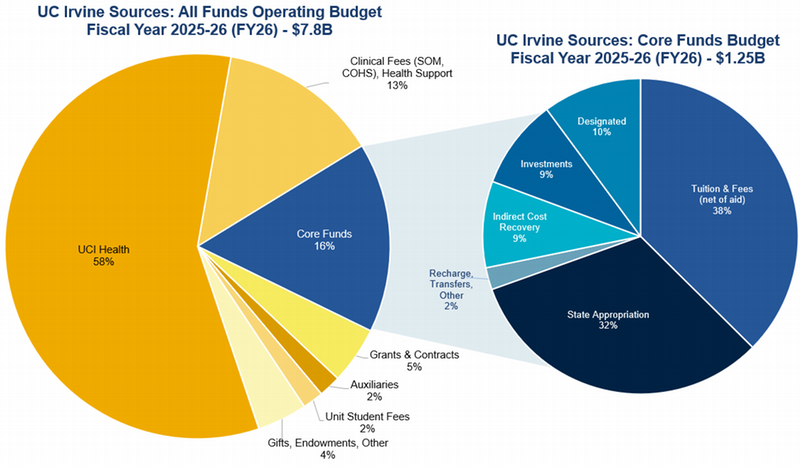

UC Irvine’s 2025-26 all-funds operating budget is $7.8 billion. Approximately half of the budget is attributed to UCI Health and its patient care services. Another third comes from non-core funds such as auxiliary units (like housing and parking), contract and grant expenditures, and health-related income that goes to the campus. The remaining funds, around $1.25 billion, are known as core funds and are the main focus of the financial stability plan. A description of each core and non-core fund source is provided here.

Summary

UC Irvine has made progress toward financial stability, but the work is far from complete.

Central Campus Resources

With implementation of the new mission-based budget model, central resources have stabilized. The prior incremental budget approach and related funding policies allocated funds for salary and benefit increases even when resources didn’t exist, rapidly depleting central reserves. The new mission-based budget model allocates each unit’s share of available funds, avoiding overcommitment. Central reserves, combined with new revenue strategies and cost reductions, provide a modest buffer against financial uncertainties and potential impacts from federal funding changes.

School/Division Resources

The change in funding approach and continuing trend of expense growth outpacing the growth in core revenues means that most schools and divisions still face structural deficits. Prior and current budget cuts, along with unfunded salary and benefit increases, mean units are managing significant operational pressures. Future projections include additional risks due to uncertainties around federal funding, indirect cost rates, international enrollment, state revenues, rising costs, and health-related program funding.

The Road Ahead

The FY26 budget and multi-year plan show an improved outlook (figure 1)—but only if every unit meets its savings targets and fully implements planned actions. This means:

- Unit-level actions: Reducing faculty and staff FTE, shifting costs to allowable non-core funds, pursuing new revenue streams, and making difficult program and structural changes.

- Central support and coordination: Driving efficiencies across units, providing guidance on budgeting and prioritization, and monitoring progress toward financial targets.

Core Funds

Core funds make up about 16% ($1.25B) of the all-funds operating budget and primarily support the university’s core missions of teaching, research, and public service. Tuition and fees and the state appropriation account for around 70% of core funds.

Tuition and fees include tuition and non-resident supplemental tuition (NRST), net of aid; student services fee (SSF); professional degree supplemental tuition (PDST); and summer session fees. Decisions regarding tuition, fees, and enrollment are determined by, or in consultation with, the UC Office of the President (UCOP).

The state appropriation is the annual funding received from the State of California, which depends on state legislation and revenue levels.

Indirect cost recovery (ICR) funds are generated as a result of research expenditures. They help cover costs for administration, maintenance, utilities, and other research-related costs that cannot be charged directly to grants. ICR has grown by 15% in each of the past two years as UC Irvine’s research portfolio has expanded.

Investments earnings and G&A assessment - All cash balances for the campus and medical center (including school carryforwards and faculty accounts) are invested in a variety of UCOP-managed investment pools and the resulting investment earnings support campus programs and operations. Auxiliary and self-supporting units, including UCI Health are charged a general and administrative assessment to help recover the indirect costs of institutional support activities.

Non-Core Funds - UCI Health

UCI Health makes up approximately 58% of total university revenues, reflecting an increase due to the addition of new medical facilities on the north campus and the acquisition of four hospitals across Orange County. This expansion of the UCI Health portfolio represents a transformative opportunity to extend its presence and impact in the Orange County community.

As UCI Health grows, more funds flow from the health enterprise to the campus. Clinical revenues and health services/support funds represent significant contributions to academic and support functions, including for the School of Medicine. It is expected that G&A resources for campus core funds will increase as the health enterprise expands. For detailed financial information, see the UC Medical Center Annual Reports.

Non-Core Funds - Other

Other non-core funds sources include contracts & grants, private gifts, health services, clinical revenues, auxiliary services, and other revenues. Funds from these sources are generally restricted for a specific purpose. Due to their restricted use, non-core resources cannot fully offset the challenges impacting core funds, which remain a critical focus for achieving financial sustainability.

Contracts & grants reached a record $668 million in FY2023-24, reflecting years of intentional campuswide investments in research infrastructure, faculty, and initiatives. These funds are used to cover direct research expenses, with the ICR funds generated by these expenditures used to support campus operations, as described in the Core Funds section.

Private gifts are comprised of gifts and endowments from fundraising efforts. The Brilliant Future campaign has achieved significant success, reaching 95% of its $2 billion goal as of June 2024. While gifts and endowments support campus programs and priorities, most are not represented in the all-funds operating budget. Instead, they are reported in the financials of entities that manage them (e.g., UCI Foundation, Office of the President Investment Office). The spendable portion of these gifts is a non-core source that supports various campus operations and initiatives.

Health services/support and clinical revenues are directly correlated with the health enterprise. Health services/support represent funds flowing from the clinical health enterprise to the campus, while clinical revenues come from payments for professional services provided by professors and clinical faculty in the School of Medicine (SOM) and other areas of the College of Health Sciences (COHS).

Educational activities are derived from sales of products or services from academic units to external organizations related to or as byproducts of education and research activities.

Auxiliary services like housing, dining, and parking operate on a self-supporting basis, focusing on minimizing cost increases while maintaining quality services for students and the community. Although there were some difficulties during the pandemic, they have all since recovered and are looking strong for the future.

Other miscellaneous revenues include tuition from self-supporting degrees and other miscellaneous student fees that contribute to the cost of running certain programs. For descriptions on the various student fees visit the University Registrar’s webpage.

Note: Funds flow from health services/support, clinical revenues, and auxiliary units to the core budget through the general & administrative (G&A) assessment that recovers indirect costs and also includes a campus contribution.

Addressing the Core Funds Structural Deficit

What is a Structural Deficit?

A structural deficit occurs when the university’s ongoing uses (expenses) consistently exceed its ongoing sources (income). Unlike a temporary budget shortfall, this is a recurring gap that requires long-term solutions.

Financial Forecast

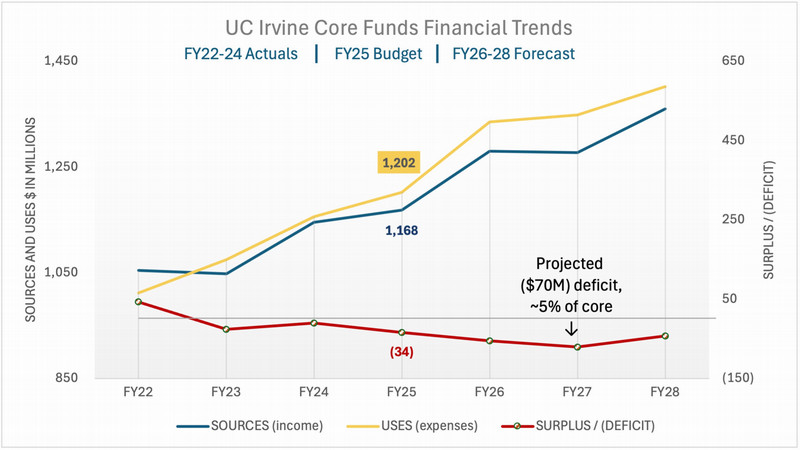

UC Irvine is facing a core funds structural deficit due to the fact that uses of funds have been increasing at a faster rate (5-8% per year) than sources of funds (1-4% per year). The current multi-year financial forecast includes actual sources and uses for FY23-FY25, the approved budget for FY26, and projections for FY27-FY28.

A plan has been established to address the remaining projected structural funding gap, defined in fall 2024 as $70 million, or about 5% of the core funds budget. This budget forecast is encouraging on paper, but financial stability depends on successful execution across all units as most schools and divisions still face structural deficits as captured in the orange shaded area showing the projected deficit if unit savings plans are not realized.

We are committed to transparency and will update this page annually in fall and as new information becomes available.

Key Drivers of the Structural Deficit

There are a number of factors impacting the rates of increase for different revenue sources and expenses.

Flat enrollment and limited tuition rate increases since 2012 have constrained tuition revenue growth. The Tuition Stability Plan is helping by providing steady rate increases for each incoming cohort. The benefits of the UC tuition stability plan will be fully realized in FY26, aligning tuition rate increases with the consumer price index.

The state-UC multi-year compact agreement (2022-23 through 2026-27) targets a 5% annual increase to UC's budget, conditional on state revenues and shared progress metrics. Due to state revenue challenges, compact commitments are deferred, and a budget cut was applied to FY26. There are continued uncertainties about state revenues that may affect the funding committed in the compact.

Non-resident undergraduate enrollment has been capped at 18.5% since 2017-18, so NRST growth is limited to rate changes. A greater rate increase for non-resident supplemental tuition would help offset some of the state budget cut (subject to proposal by UCOP and approval by the Regents).

Total undergraduate enrollment is nearing the campus goal set by our long-range development plan, restricting revenue growth from additional students. This plan is being updated over the next several years to allow for potential future growth.

Salaries and benefits together account for 70% of the core funds operating budget. Salary plans and bargaining contract commitments that exceed revenue growth have a significant impact on the structural deficit. Benefits costs are increasing faster than inflation due to increases in the employer contribution to the UC retirement plan and rapidly rising health benefit costs.

Rising expenses impact all university activities. Non-payroll costs are expected to increase anywhere from 2-4% per year. Inflation on utilities, supplies and materials, compliance requirements, and expanded student aid to support diversity and access all contribute to expenses growing faster than revenue.

Although pandemic operations have been minimized, UC Irvine faces annual debt repayments of approximately $14 million from working capital bonds used to cover COVID-related costs.

Working Towards Financial Stability

As we endeavor to achieve and maintain a sustainable financial plan, we are committed to keeping the campus updated, consulting with Academic Senate and other campus stakeholders to develop well-informed action plans and making thoughtful decisions about how best to support the academic mission.

Tracking Our Progress

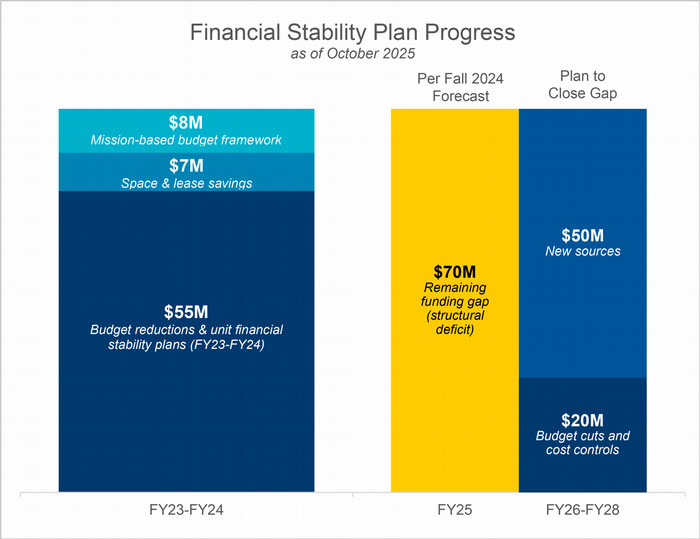

The graphic illustrates UC Irvine’s progress in addressing its structural deficit. From FY23–FY25, significant advancements were made through budget reductions, unit financial stability plan actions, space and lease cost reductions, and budget reallocations aligned with the mission-based budget model.

This progress reflects the collective efforts and dedication of the campus community in addressing the funding gap. Ongoing achievements demonstrate a commitment to fiscal responsibility by identifying new funding sources, leveraging non-core resources, and improving operational efficiency.

Addressing the Funding Gap

- A $70M funding gap was projected by FY27 in fall 2024 if no actions were taken to offset the ongoing fiscal challenges as rising costs continue to outpace revenues. The projected deficit is not yet resolved, but we have a plan:

- $20M from budget reductions.

- $40M from G&A growth in health operations and increase rates from self-supporting/auxiliary activities.

- $10M from other revenue growth (gifts, tuition/fee increases).

- FY26 budget shows improved financial projection, but achieving the plan will take substantial effort.

- Challenges come from prior/current budget cuts and unfunded salary increases.

- Schools/divisions are implementing financial stability plans: reduced FTE, shifting costs to non-core, and identifying opportunities for revenue growth over three years.

- Additional campus savings are expected through operational efficiencies. Future revenue carries risks due to federal, state, and international uncertainties.

Greater Transparency and Planning Tools

The transition to an all-funds, multi-year planning approach provides campus units with tools to better project expected resources, anticipate funding needs, and manage challenges. This approach brings more transparency to funding decisions and allows for scenario planning and risk assessments, which help make better informed decisions in an uncertain economic and political climate. As improvements continue to be made in planning tools and reports, the campus is committed to increasing transparency in financial planning and budgeting.